Loan Interest

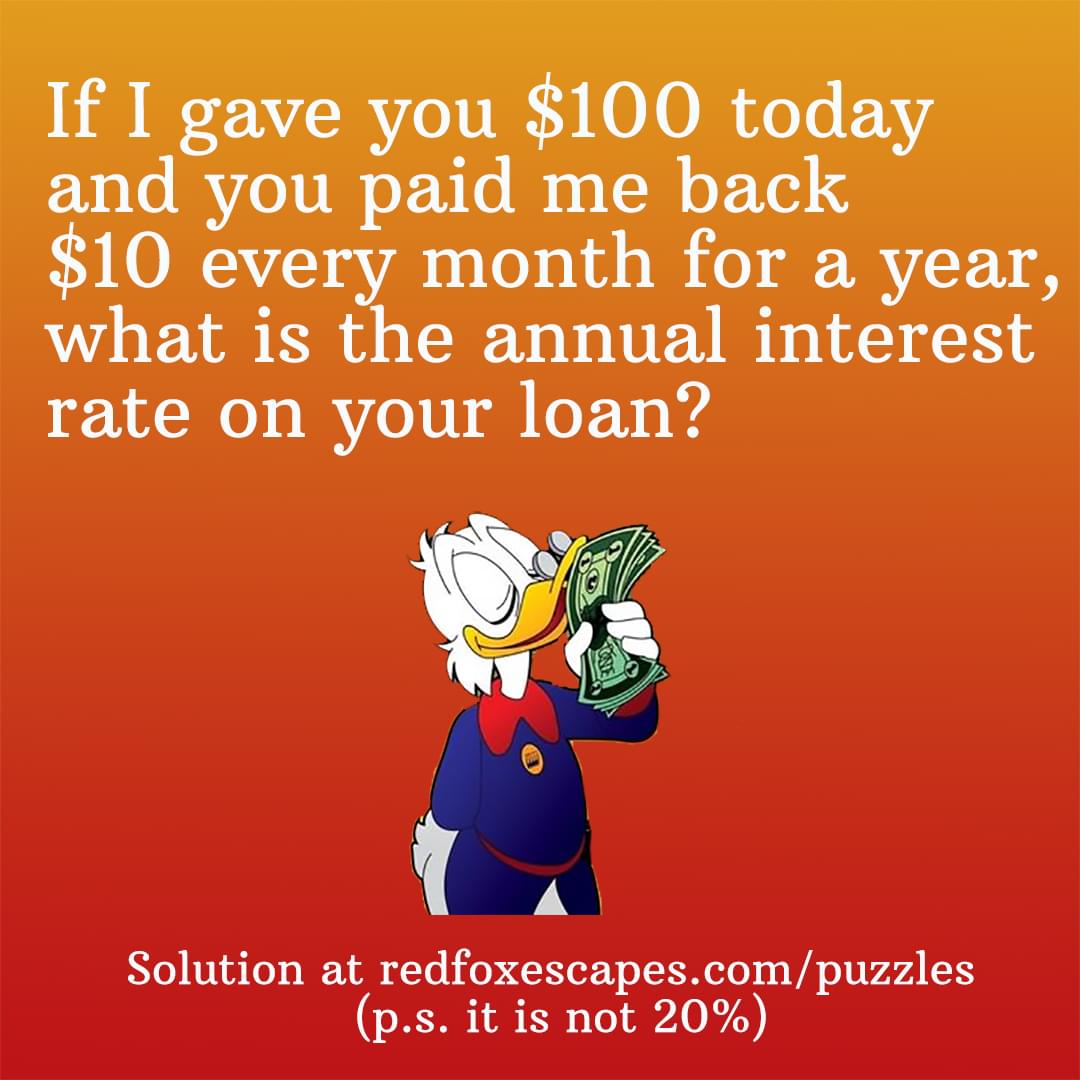

If I gave you $100 today and you paid me back $10 every month for a year, what is the annual interest rate on you loan?

(p.s. it is not 20%)

Show solution

If I gave you £100 today and you paid me back £10 every month for a year, what is the annual interest rate on your loan?

Gut answer: 20 per cent.

Correct answer: a number between 21 and 119 per cent (it’s actually about 41.3 per cent, which is hard to calculate. Since the point of the puzzle was not to do a complicated calculation, but to realise that the question is more sophisticated than at first glance, I gave a wide range as one of the four options.)

Percentage who got the right answer: 18.2 per cent (most popular answer was 20 per cent, with 63 per cent)

Comment: This is the question that Shane Frederick asked Harvard students and they all got it wrong. (As I did too when Tim Harford first showed it to me.) The error comes in misunderstanding how interest works. When you borrow money, you only pay interest on money that you owe. If I borrowed £100 and, at the end of the year, paid £120 back in one go, then the interest rate would indeed be 20 per cent. Yet the question asks a more subtle question, since the amount owed changes through the year. You are effectively borrowing £100 for a month, then £90 for a month, and then £80 for a month, and so on, until after ten months you are borrowing nothing at all. A back of the envelope calculation makes this roughly equivalent to borrowing about £50 (the average of all the monthly amounts you owe) for the year. Since you are paying back £20 more than you borrowed, the interest is gong to be about 20/50 = 40 per cent. If anyone wants to calculate the precise sum below the line, please do!

You might complain that this question assumes a thorough grasp of how interest works. Fair comment. But the whole point of the exercise is to realise that it is important to stop and think. And when it comes to financial matters, this issue is particularly pertinent. Says Tim Harford: “Companies love expressing loans this way to disguise the true interest rate – which is why regulators have to force them to report interest payments in a consistent way.”